CARROT | IMPORTERS | CZECH REPUBLIC

The Strategic Landscape of Fresh Carrot Imports in the Czech Republic: A Comprehensive Market Analysis

1. Executive Market Architecture and Economic Context

The fresh produce market in the Czech Republic represents a sophisticated, highly consolidated European trading node that serves as both a final destination for domestic consumption and a transit hub for Central European logistics. Within this ecosystem, the trade of fresh carrots (Daucus carota) offers a compelling case study of the tension between strong domestic agricultural heritage and the relentless demands of modern, year-round retail availability. This report provides an exhaustive analysis of the import mechanisms, key corporate entities, and strategic entry points for fresh carrots, designed for industry stakeholders requiring actionable intelligence on the Czech market.

1.1 The Structural Deficit: The "Carrot Gap"

To comprehend the import market, one must first analyze the production-consumption deficit that necessitates foreign trade. The Czech Republic lies in a temperate climate zone capable of high-quality root vegetable production, particularly in the Polabí (Central Bohemia) and South Moravian lowlands. However, the nation is structurally unable to meet its own consumption requirements year-round due to a combination of climatic limitations, storage technology costs, and consumer purchasing behavior.

Data indicates that the average Czech citizen consumes approximately 81 kilograms of vegetables annually, with a significant portion being root vegetables like carrots, celeriac, and parsley—the "holy trinity" of Czech culinary bases (used in soups and the national dish Svíčková).

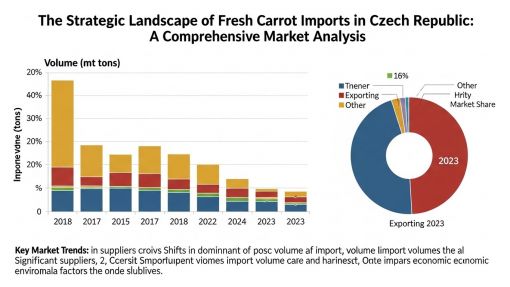

The import market is not merely a supplement; it is a critical structural component. In 2023, the Czech Republic imported over 35.35 million kilograms of fresh carrots and turnips.

1.2 Geopolitical and Economic Drivers

The Czech market does not exist in a vacuum. It is deeply integrated into the European Single Market, yet it retains distinct economic characteristics due to its retention of the Czech Koruna (CZK).

Currency Volatility and Import Costs:

Unlike its neighbor Slovakia, the Czech Republic manages its own currency. This introduces a layer of Foreign Exchange (FX) risk for importers. When the Koruna weakens against the Euro, the cost of importing carrots from the Netherlands or Italy rises immediately. Major importers like Čerozfrucht and Hortim mitigate this through hedging strategies and flexible sourcing contracts, often shifting procurement to Poland (where the Złoty often moves in correlation with the Koruna) when the Eurozone becomes too expensive. Conversely, a strong Koruna encourages the importation of premium "bunched" carrots from Italy and Spain, as purchasing power parity improves for Czech supermarkets.

Inflationary Pressures:

Recent years have seen significant food inflation in the Czech Republic. The price sensitivity of the Czech consumer is high, particularly for staple goods like carrots. This drives a bifurcation in the import market:

The Price Fighter Tier: Dominated by bulk imports from Poland and Germany, sold in 10kg nets or generic 1kg flow-packs at discounters like Lidl and Penny Market.

The Premium Tier: Driven by "new crop" imports from Southern Europe (Italy, Portugal) and organic produce, catering to the affluent urban demographics in Prague and Brno who are less price-sensitive and prioritize freshness and origin.

1.3 Historical Evolution of the Trade

Post-1989, the Czech vegetable market transitioned from a fragmented, localized system to a highly centralized model dominated by foreign retail capital. In the 1990s, the market was flooded with imports as inefficient collective farms collapsed. By the 2000s and 2010s, a consolidation occurred where successful domestic growers (like Bramko) adopted Western agronomy and storage technology, reclaiming the summer and autumn market share. Today, the market has reached a maturity phase characterized by "Programmatic Buying"—where imports are not spot trades but pre-planned logistical flows integrated into the annual calendars of retail giants like the Schwarz Group (Kaufland/Lidl) and REWE Group (Billa/Penny).

2. Domestic Agronomy and the Storage Cliff

Understanding domestic capability is the inverse of understanding import opportunity. An exporter acts effectively only when they understand when and why the local competitor fails.

2.1 The Domestic Harvest Calendar

The Czech agricultural calendar for carrots dictates the window of opportunity for imports.

| Month | Domestic Activity | Import Status | Dominant Origin |

| July - October | Peak Harvest. Fresh carrots from Polabí flood the market. Prices hit annual lows. | Low. Restricted to specific premium formats (e.g., organic, baby) or industrial contracts. | Poland (Processing), Netherlands (Specialty) |

| November - January | Storage Season. Market supplied by domestic "Ice Bank" and cold storage stock. Quality is generally good. | Medium. Imports supplement size grades or cover specific retail promotions. | Netherlands, Germany |

| February - March | The Storage Cliff. Domestic stock quality degrades (silvering, sprouting). Premium retailers switch to imports. | High. The "New Crop" window opens. | Netherlands (Washed), Italy (Bunched) |

| April - June | Peak Deficit. Domestic stock exhausted. Massive demand for fresh imports. | Peak. The most lucrative window for exporters. | Italy, Spain, Portugal, Israel |

2.2 Storage Technology and Limitations

Czech producers have invested heavily in storage technology, particularly under the guidance of major cooperatives like Bramko and Litozel. The standard technology involves:

Ice Banks: Using latent heat of ice to maintain high humidity (98%) and low temperature (near 0°C). This prevents the dehydration ("whitening") of carrots, which is the primary cause of rejection by retailers.

Hydro-cooling: Rapid cooling of the crop immediately after harvest to remove field heat.

Despite these advancements, the "Storage Cliff" remains. By March, even the best-stored Czech carrot struggles to compete visually with a freshly harvested carrot from Sicily or a high-tech stored carrot from the Netherlands (where storage infrastructure is decades ahead in scale). This visual discrepancy drives the import market. Retail buyers for chains like Albert know that a slightly shriveled domestic carrot will sit on the shelf, while a bright, crisp Italian bunch will sell, justifying the higher import cost.

2.3 The Impact of Climate Change

The snippets allude to the impact of droughts and weather variability on Czech production. The Czech Republic has faced severe hydrological droughts in recent years, impacting yield per hectare in non-irrigated regions. In years of severe drought, the "Import Window" widens significantly, starting as early as December. Exporters with irrigation-secured production (e.g., in the Netherlands or Scandinavia) find the Czech Republic a vital "overflow" market during these stress years.

3. The Landscape of Importers: A Multi-Tiered Ecosystem

The Czech import market is not a monolith. It is stratified into three distinct tiers of corporate entities, each with different buying behaviors, risk profiles, and operational capabilities. Understanding these profiles is essential for any supplier attempting to initiate a commercial relationship.

3.1 Tier 1: The Integrated Logistics Giants (The Gatekeepers)

These entities are the primary conduit for the vast majority of fresh pr

oduce entering the Czech retail sector. They are not merely traders; they are logistics service providers who manage the entire supply chain for supermarkets.

ČEROZFRUCHT s.r.o. (The Logistical Backbone)

Corporate Profile: A titan of the Central European produce industry. Headquartered in Prague-Strašnice with massive logistical hubs in Nehvizdy and Brno.

5 Operational Scale: The company reports revenue in the billions of CZK, indicating massive throughput. They possess the financial liquidity to finance huge import programs and the physical infrastructure to handle them.

Carrot Operations:

Procurement: Čerozfrucht acts as a global sourcing desk. They buy carrots from the Netherlands (washed), Poland (industrial), and Southern Europe (bunched).

Value Addition: Their facility in Nehvizdy is equipped with advanced packing lines capable of washing, polishing, and packing carrots into net bags, flow-packs, and trays. This "re-packing" capability is crucial because it allows them to import bulk produce (in 1-tonne jumbo bags) and convert it into the private-label formats required by chains like Tesco or Albert.

Ripening and Storage: While famous for their banana ripening rooms, this same climate-control expertise is applied to root vegetables to maintain the cold chain during the critical "last mile" to the supermarket depot.

7

Strategic Role: For a foreign exporter, Čerozfrucht is a "one-stop-shop" for the Czech market. A contract with Čeroz often ensures distribution across multiple retail banners. However, their bargaining power is immense, and they demand strict adherence to IFS/BRC standards.

HORTIM International (The Global Partner)

Corporate Profile: Based in Brno, Hortim is a major player with a footprint that extends into Slovakia. They distribute approximately 395 million kilograms of produce annually.

8 The "Hybrid" Advantage: Unlike pure traders, Hortim owns Farm Božice, a domestic production entity growing over 15 products.

8 This gives them a unique "Grower-Importer" identity. They can supply "Czech Carrots" when available and seamlessly switch to imports when local stock runs out, maintaining the same SKU code and shelf space for the retailer.Infrastructure: Their logistics network is supported by a fleet of over 25,000 truck movements annually.

8 They operate state-of-the-art warehouses in Brno and Prague, utilizing computerized warehouse management systems (WMS) to track inventory age and rotation—critical for perishable root vegetables.Import Philosophy: Hortim’s branding emphasizes "We Import, We Cultivate, We Pack." They likely have long-standing strategic alliances with major European grower groups (e.g., The Greenery in NL or Anecoop in ES), making it difficult for spot-market traders to break in without a unique value proposition.

EFES spol. s r.o. (The Agile Specialist)

Corporate Profile: Located in the logistics hub of Prague-Třebonice, Efes distinguishes itself through agility and a focus on direct logistics.

9 Operational Focus: Their marketing highlights their own fleet equipped with GPS and temperature monitoring. This suggests a focus on high-value, sensitive produce where cold chain integrity is paramount—such as early season bunched carrots from Italy which wilt rapidly if mishandled.

Certifications: They heavily promote their IFS, BRC, and ISO certifications, positioning themselves as a "safe" partner for risk-averse multinational retailers and high-end gastronomy clients.

11

3.2 Tier 2: The Producer-Importers (Vertical Integration Champions)

This is the most strategically interesting segment of the Czech market. Major domestic farming cooperatives have evolved into importers to defend their shelf space. They realized that to keep a contract with a giant like Kaufland, they must supply carrots 365 days a year, not just during the Czech harvest.

BRAMKO (Družstvo Bramko CZ)

Case Study in Integration: Bramko is arguably the most sophisticated root vegetable operation in the country. Based in Semice, they cultivate 150 hectares of carrots domestically.

12 The Portugal Connection: To solve the winter deficit, Bramko established a sister company, Camposol II Lda, in Portugal.

12 This allows them to grow carrots in the Portuguese winter and import them to the Czech Republic.Strategic Impact: Bramko imports its own produce. This vertical integration gives them total cost control and traceability from a Portuguese field to a Czech supermarket shelf, bypassing traditional traders.

Import Needs: Despite this, Bramko explicitly states they buy from "foreign suppliers" to supplement their assortment.

12 They are a prime target for exporters who can supply varieties or volumes that their own farms (CZ/PT) cannot match, such as specific organic specifications or processing grades.Facility: Their Semice headquarters features massive washing and optical sorting lines (likely Newtec or similar tech), enabling them to process incoming bulk imports to identical standards as their domestic crop.

LITOZEL & ZELTR

Role: These are "Odbytová družstva" (Sales Cooperatives) representing networks of smaller growers in North Bohemia and Moravia respectively.

13 Import Activity: While their mandate is to sell members' crops, they maintain import licenses to fill gaps. However, compared to Bramko, they are less aggressive in the import space and more focused on domestic aggregation. They are often the entities lobbying for "Czech Origin" protectionism, making them complex partners for importers.

3.3 Tier 3: The Specialized Wholesalers & Gastronomy Supply

The "Lipence" Wholesale Market (Velkotržnice Lipence) in Prague remains a hub for this tier, serving independent retail and the HORECA (Hotel/Restaurant/Catering) sector.

TEKOO (Bidfood Czech Republic)

Profile: Tekoo is the fresh produce arm of Bidfood, the dominant foodservice distributor in the Czech Republic and Slovakia.

15 Market Segment: They supply factory canteens, school cafeterias, hospitals, and restaurants.

Carrot Needs: This sector has specific, non-retail requirements:

Processed Carrots: Huge demand for peeled, diced, or julienned carrots for mass catering. Tekoo likely imports these pre-processed from Poland or processes them in facilities like their Kralupy plant.

15 Stability: Unlike retail, which fluctuates with consumer whims, institutional catering needs stable, predictable pricing and volume.

Specialty: For fine dining, they import niche items like "Purple Haze," "White Satin," or "Chantenay" baby carrots, often from specialized Dutch or French traders.

Regional Wholesalers (e.g., Míča Bagoňová, Orange Plzeň)

Role: These entities act as regional distributors, breaking down pallets from the big importers (Čeroz/Hortim) or importing directly from nearby hubs like the Munich Wholesale Market or Vienna Market to serve local independent stores and schools in regions like Plzeň or Brno.

16

4. Retail Procurement: The Buying Alliances

In the Czech Republic, the "Supermarket" is the kingmaker. The retail sector is highly concentrated, with the top groups controlling the vast majority of food sales. Exporters must understand that "selling to the Czech Republic" usually means selling to one of these buying alliances.

4.1 The Schwarz Group Dominance (Kaufland & Lidl)

The German Schwarz Group is the undisputed heavyweight of the Czech grocery market.

Kaufland (Hypermarkets):

Volume: Kaufland moves massive volumes of produce. Their "10kg Winter Carrot Net" is a staple product for Czech households.

Procurement: They utilize a centralized buying platform but have a dedicated Czech purchasing office. They are pioneers in EDI (Electronic Data Interchange), requiring suppliers to be digitally integrated for orders, delivery notes, and invoicing.

18 Standards: They demand strict residue limits, often going beyond EU law (e.g., requiring residues to be max 33% of the MRL).

Lidl (Discounter):

Strategy: "Less is More." Lidl carries a limited range of carrot SKUs (usually just Standard 1kg, Bio 1kg, and Bunch).

Buying: Highly centralized. Lidl often tenders contracts for the entire region (CZ/SK). Winning a Lidl tender guarantees massive volume but at razor-thin margins. They heavily utilize their "Lidl Plus" app to drive traffic, meaning an importer must be ready for sudden demand spikes when carrots are the "Deal of the Week".

19

4.2 The REWE Group (Billa & Penny Market)

Billa: Positions itself as a "quality supermarket." They are a key outlet for premium imported carrots, such as "bunched carrots" from Italy or "snack carrots" in cups. They are less price-aggressive than Lidl, allowing for slightly higher margins on differentiated products.

Penny Market: The direct competitor to Lidl. Sourcing is often coordinated via REWE's international trading desks in Germany (REWE Eurogroup), making it hard for small exporters to bypass the central buying hub.

4.3 Albert (Ahold Delhaize)

Strategy: Albert has successfully rebranded from a generic hypermarket to a "Fresh Food" destination. They place a huge emphasis on the "Marketplace" feel of their produce section.

Sourcing Transparency: Uniquely, Albert's online store explicitly lists the potential countries of origin for their carrots: "Czech Republic, Italy, Germany, Portugal".

4 This transparency indicates a flexible sourcing policy that shifts origin based on the best available quality in a given week.Supplier Engagement: Albert uses a "Red Door" policy similar to Tesco, encouraging new suppliers to pitch directly, particularly those with sustainability credentials or unique varieties.

20

4.4 Tesco

Regional Hub: Tesco operates a "Central Europe" structure, procuring for the Czech Republic, Slovakia, Hungary, and Poland as a bloc.

Sustainability Leadership: Tesco is a leader in food waste reduction. They have initiatives like "Perfectly Imperfect" (utilizing crooked or small carrots), which offers an outlet for Class II imports that might otherwise be rejected. Exporters aligned with these sustainability goals have a strategic advantage.

21

4.5 The Online Disruptors (Rohlik.cz & Kosik.cz)

The Phenomenon: The Czech Republic has one of the highest penetrations of online grocery shopping in the world. Rohlik.cz (reaching unicorn status) and Kosik.cz are major players.

Carrot Strategy: These players differentiate on quality and story. They list the specific farmer's name. They are the primary channel for high-end organic imports, "heirloom" varieties, and premium baby carrots that are too niche for the discount-focused brick-and-mortar chains.

22

5. Strategic Deep Dive: Operations and Logistics

The physical movement of carrots from a farm in Southern Europe to a shelf in Prague involves a complex, high-stakes logistical ballet.

5.1 The Cold Chain Infrastructure

Carrots are physiologically active after harvest; they respire and lose moisture. The Czech supply chain relies on specific infrastructure to mitigate this:

Hydro-Cooling: Imports arriving from warmer climates (Italy/Spain) in spring must be hydro-cooled (showered with near-freezing water) to arrest respiration. Facilities like those at Bramko (Semice) and Čerozfrucht (Nehvizdy) are equipped for this.

The "Last Mile" Challenge: While the trunk haul (e.g., Almeria to Prague) is handled by refrigerated 18-wheelers, the distribution from the Czech DC to the store is critical. Companies like Efes invest in fleet telematics to prove to retailers that the temperature never spiked above 4°C during delivery, ensuring the "snap" of the carrot is preserved.

10

5.2 Packaging and Processing

The era of the "dirty bulk carrot" is fading in the mainstream market.

Optical Sorting: Leading importers utilize optical graders (technology from manufacturers like Tomra or Newtec) to size and grade carrots by diameter, length, and defect (splits/black spots). This ensures that every bag in a Kaufland store looks identical, a requirement for the modern consumer.

Polishing: "Polished" carrots (brush washed) are the standard for premium lines. This removes the outer skin layer, making the carrot bright orange but reducing shelf life, thus necessitating faster logistics.

Packaging Formats:

1kg Flow-pack: The industry standard.

10kg Raschel Bag: The "winter warmer" format for heavy users (soups/stews).

Plastic Reduction: There is growing pressure to reduce plastic. Retailers are experimenting with cellulose netting or paper banding for bunched carrots, presenting an innovation opportunity for exporters.

5.3 Labor and Automation

The Czech Republic faces a chronic labor shortage, with unemployment rates often the lowest in the EU. This drives importers to automate.

Robotic Palletizing: Warehouses like Hortim’s are increasingly automated to reduce reliance on manual labor for stacking heavy carrot crates.

Pre-Processing: This drives the demand for imported processed carrots (peeled/diced) for the HORECA sector, as Czech restaurants cannot find staff to peel carrots manually.

6. The Organic (BIO) and Specialty Frontier

While conventional carrots dominate volume, the value growth lies in the "Bio" and "Specialty" segments.

6.1 The Organic Ecosystem

Market Share: Organic carrots are a "gateway drug" to the organic category due to their relatively low price premium compared to other bio produce.

Key Player: Country Life s.r.o. is the historic pioneer of the Czech organic movement. They act as a dedicated organic wholesaler, importing produce that meets strict bio-certification standards.

23 Retail Bio: Mainstream retailers (Lidl/Albert) have aggressively expanded their "Bio" private labels. These are rarely sourced from small local farms (too unreliable) but rather from large-scale organic aggregators in Austria, Italy, or the Netherlands who can guarantee supply.

6.2 The "Snack" Revolution

Baby Carrots: The consumption of raw carrots as a healthy office/school snack is rising.

Sourcing: True "Baby Carrots" (cut and peeled from mature roots, American style) or "Baby" varieties (harvested young) are almost exclusively imported. Specialized processors in Denmark and the Netherlands dominate this niche, supplying pre-packed snack cups to gas stations and convenience stores.

7. Regulatory Framework and Quality Standards

Entering the Czech market is not just a commercial negotiation; it is a compliance hurdle.

7.1 Mandatory Certifications

GlobalGAP (IFA): The non-negotiable baseline. No major Czech retailer will list a supplier without a valid GlobalGAP certificate for the farming operations.

GRASP: The "Risk Assessment on Social Practice" add-on to GlobalGAP is increasingly mandatory, especially for Lidl and Tesco, to ensure ethical labor practices (preventing modern slavery in the supply chain).

IFS Food / BRCGS: Required for any post-harvest facility (packhouse). If an exporter packs the carrots into retail bags, their facility must hold one of these GFSI-benchmarked certifications.

7.2 Phytosanitary and Residue Limits

MRLs (Maximum Residue Limits): The Czech State Agricultural and Food Inspection Authority (SZPI) is vigilant. They regularly test retail produce.

"Secondary Standards": Chains like Kaufland often impose stricter limits than the EU law (e.g., demanding only 33% of the legal residue limit). Exporters must review their spray programs to meet these "super-compliant" standards.

7.3 Labeling Laws

COOL (Country of Origin Labeling): Strictly enforced. The origin must be clearly displayed. Mislabeling (e.g., selling Polish carrots as Czech) is a major offense that can lead to delisting.

8. Strategic Recommendations for Exporters

Based on this exhaustive analysis, the following strategic pathways are recommended for exporters seeking to penetrate the Czech fresh carrot market.

8.1 The "Partner-Producer" Strategy (The Golden Path)

Do not try to compete with Bramko; partner with them.

Rationale: Bramko needs volume to keep its washing lines running and its retail contracts active during the off-season.

Strategy: Position your supply as the "counter-seasonal" plug-in to their integrated model. If you are in Southern Europe, offer them the "Spring Bridge" (March-May). If you are in Northern Europe, offer them "Emergency Buffer Stock" for drought years.

8.2 The "Programmatic" Approach

Avoid the spot market. The Czech market rewards stability.

Strategy: Approach Čerozfrucht or Hortim with a "Program Proposal." Offer a fixed volume per week at a formula price (e.g., linked to the German AMI index) for a 12-week window. This speaks the language of their procurement directors who are managing risk, not just price.

8.3 Niche Differentiation

If you cannot compete on bulk price (against Poland), compete on attributes.

Strategy: Target Tekoo (Bidfood) or Rohlik.cz with unique varieties (e.g., Sweet Chantenay, Purple Haze) or specific sizes (e.g., <20mm diameter="" for="" glazing="" these="" buyers="" pay="" differentiation="" span="">

8.4 Technical Alignment

Ensure your technical specs align with Czech preferences.

Visuals: Czech consumers prefer a "cylindrical, blunt-ended" carrot (Nantes type). Tapered or irregular carrots are viewed as "fodder grade."

Washing: Invest in high-quality polishing. A rough-washed carrot will be relegated to the discount bin; a polished carrot goes to the premium shelf.

9. Comprehensive Directory of Key Entities

The following directory synthesizes the operational details of the primary entities identified in this research.

| Company Name | Type | Operational Focus | Key Locations | Relevance to Carrot Import |

| BRAMKO s.r.o. | Producer-Importer | Root Vegetables | Semice (Central Bohemia) | Critical. Major grower with washing lines. Imports off-season. Owns Camposol II (Portugal). |

| ČEROZFRUCHT s.r.o. | Distributor/Logistics | Full Assortment | Nehvizdy, Prague | Critical. Logistics giant. Supplies all chains. Massive packing/ripening infrastructure. |

| HORTIM International | Distributor/Logistics | Full Assortment | Brno, Prague | Critical. Global scale. "Grower-Importer" model via Farm Božice. |

| EFES spol. s r.o. | Importer | Fruit & Veg | Prague-Třebonice | High. Agile importer with own fleet. Strong in Southern European imports. |

| TEKOO (Bidfood) | Wholesaler | Gastronomy/HORECA | Uherské Hradiště, Kralupy | High. Key for processed (peeled/diced) and premium garnish carrots. |

| COUNTRY LIFE s.r.o. | Wholesaler | Organic/BIO | Nenačovice | Niche. Primary entry point for certified organic carrots. |

| LITOZEL | Sales Coop | Aggregation | Bohušovice nad Ohří | Medium. Primarily sells members' crops, but holds import capacity. |

| ZELINÁŘSKÁ UNIE | Association | Industry Body | Olomouc | Indirect. Source of market data and regulatory updates. |

10. Conclusion

The Czech fresh carrot market is a sophisticated arena where success is determined by logistics, certification, and strategic alliances. It is no longer a dumping ground for surplus European produce but a quality-conscious market integrated into the highest tiers of the European retail system. For the prepared exporter—one who brings GlobalGAP certification, modern packaging capabilities, and a clear understanding of the seasonal "Carrot Gap"—the Czech Republic offers a stable, high-volume opportunity anchored by some of the continent's strongest retail and logistical partners.