DRIED FRUIT | MARKET RESEARCH | BLOG

Global Dried Fruit Market Forecast (2025–2030)

Market Overview

Definition & Segmentation: The global dried fruit market (often referred to as “dry fruit”) encompasses edible fruits that have been naturally or artificially dehydrated to extend shelf life. Major product segments include dried grapes (raisins, sultanas, currants), dates, dried plums (prunes), dried apricots, dried figs, and various dried berries. These six categories dominate output: as of the 2023/24 season, dates and dried grapes together accounted for ~78% of world dried fruit production. In 2023/24, dates led with about 42% of global dried fruit output, and dried grapes made up over one-third; the remainder was prunes (~7%), dried cranberries (~6%), dried apricots (~5%), and dried figs (~4%)api.iib.org.tr. This product mix highlights the prominence of date-producing regions and grape-producing regions in the market.

Current Market Size: Global dried fruit production has remained relatively stable over the past decade, hovering around 3 million metric tons annuallyapi.iib.org.tr. In 2014/15, world output was ~2.95 million MT; by 2023/24 it reached 3.36 million MT, with a slight estimate of 3.33 million MT for 2024/25api.iib.org.tr. On the value side, the market has been expanding due to both volume growth and price increases. The global dried fruits market was valued at approximately $7.9 billion in 2022, growing to about $8.7 billion in 2023globenewswire.com. This jump partly reflects post-pandemic demand recovery and inflationary pressures in food commodities.Asia-Pacific currently represents the largest regional market by value (in 2022), followed by North America , thanks to high consumption in those regions (detailed in sections below). Overall, dried fruits are increasingly popular for their dense nutrient content and long shelf life, making them attractive as healthy snacks and food ingredients.

Volume and Value Growth Projections (2025–2030)

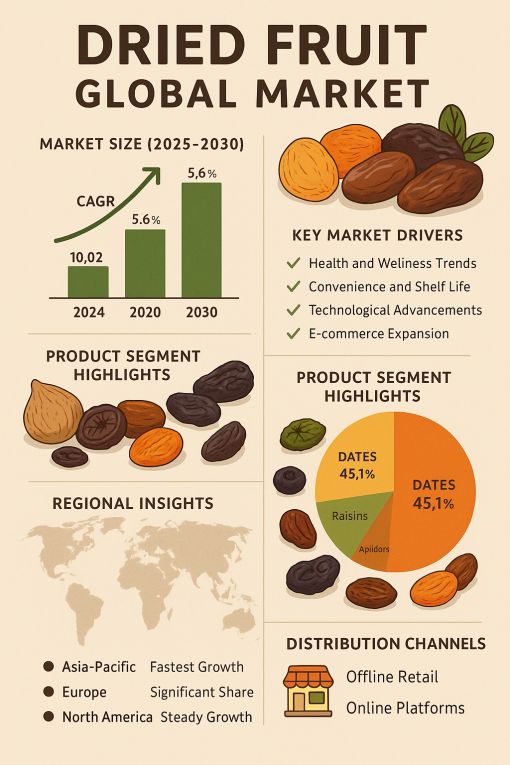

Projected Growth: Looking ahead, the global dried fruit market is poised for steady expansion through 2030. In volume terms, modest growth is expected as producers scale up output to meet rising demand: world production could approach roughly 3.8–4.0 million MT by 2030, assuming a few percent annual growth driven by dates and certain high-demand fruits (dates, cranberries, apricots have seen ~4% yearly production growth in the last decadeapi.iib.org.tr). Value-wise, the market is projected to grow faster than volume due to value addition and price factors. Forecasts indicate the global dried fruit market will reach around $16.5 billion by 2030, up from an estimated ~$12 billion in 2024grandviewresearch.comresearchandmarkets.com. This implies a compound annual growth rate (CAGR) on the order of 5–6% during 2025–2030.

To illustrate, a recent industry report projects the market expanding at ~5.6% CAGR from 2025 to 2030, rising to $16.55 billion by 2030grandviewresearch.com. Another analysis underscores similar growth, with the market (valued ~$12 billion in 2024) expected to climb to $16–17 billion by decade’s end . This growth outlook is supported by robust demand trends (discussed later) and increasing consumer awareness of dried fruits’ health benefits. In terms of volume, growth will be somewhat slower (likely low-single-digit CAGR), meaning per-unit values may increase modestly. Table 1 below summarizes the estimated market size growth:

| Metric | 2024 Estimate | 2030 Projection | CAGR (2025–2030) |

|---|---|---|---|

| Global Production | ~3.33 MMTapi.iib.org.tr | ~4.0 MMT (est.) | ~2–3% (est.) |

| Market Value | ~$12 billionresearchandmarkets.com | ~$16.5 billiongrandviewresearch.com | ~5.5–6.0%grandviewresearch.com |

(MMT = million metric tons; est. = estimated)

These projections assume stable growing conditions and continued demand momentum. Notably, growth in value outpaces volume due to anticipated price firming and a shift to higher-value products (e.g. organic or specialty dried fruits). Overall, both volume and value are on an upward trajectory through 2030, reflecting the dried fruit sector’s resilience and evolving consumer preferences.

Key Consuming Countries and Regions

Global consumption of dried fruits is concentrated in a few key regions, often tied to cultural dietary habits and population size. The Middle East is the leading consuming region, accounting for roughly one-third of global dried fruit consumption in recent yearsmarketdataforecast.com. This is driven by the region’s high intake of dates and dried grapes as staple foods and traditional treats. For example, countries like Egypt, Iran, Saudi Arabia, and Turkey have large domestic consumption of dates, raisins, and other dried fruits, both for everyday use and festive occasions. According to 2021 data, the Middle East comprised about 35% of world dried fruit consumptionmarketdataforecast.com – the single largest regional share.

Europe is another major consumer, at about 21% of global consumptionmarketdataforecast.com. European markets such as Germany, the U.K., France, and Italy are significant end-markets for imported dried fruits. In Europe, dried fruits are popular as healthy snacks and baking ingredients (e.g. raisins in breads, holiday fruit mixes). Consumer awareness of health benefits has been rising in Western Europe, boosting demandmaximizemarketresearch.com. Asia (excluding the Middle East) accounts for roughly another 21% of global consumptionmarketdataforecast.com. This includes large and growing markets like India and China. India’s consumption is substantial – it imports nearly half a million tons of dried fruits (mostly dates) annuallyinc.nutfruit.org to meet demand for traditional sweets and snacks. China’s per capita dried fruit intake is lower, but rising incomes and interest in healthy foods are accelerating demand for raisins, goji berries, and dried tropical fruits. North America represents around 11% of world consumptionmarketdataforecast.com, led by the United States. The US market consumes a wide array of dried fruits (raisins, prunes, cranberries, etc.), both as standalone snacks and as ingredients in cereals and baked goods. Americans’ focus on convenient, nutritious snacks has kept dried fruit consumption strong, though growth is moderate compared to Asia.

Other regions (Latin America, Africa outside the Mideast/North Africa, and Oceania) collectively make up the remaining ~12% of consumptionmarketdataforecast.com. Within these, certain countries stand out: for instance, Brazil and Mexico have growing consumer bases for dried fruit (often as imports), and Australia has high per capita consumption of raisins and sultanas (a reflection of local production and dietary habits). In North Africa, countries like Algeria, Morocco, and Tunisia consume significant quantities of dates (largely from domestic crops) and thus contribute to regional demand.

Consumption Drivers: Across these regions, a few common trends are fueling growth in dried fruit intake:

Health & Wellness Trend: Consumers worldwide are seeking healthier snack alternatives. Dried fruits are rich in fiber, vitamins, and minerals and contain no added sugars (in unsweetened varieties). This health halo is driving greater regular consumption in both developed markets (North America, Europe) and emerging onesmarketdataforecast.commarketdataforecast.com. For example, rising obesity and lifestyle diseases have encouraged more people to replace candy or chips with raisins, dates, or dried berries as snacksfactmr.commarketdataforecast.com.

Cultural and Traditional Uses: In the Middle East and South Asia, dried fruits (dates, figs, raisins) have long been part of traditional diets and religious/cultural festivals. This ingrained consumption (e.g. dates during Ramadan, dried fruit in South Asian sweets) ensures a steady baseline demand that grows alongside population.

Incorporation into Diets and Recipes: Consumers in Western markets are eating more dried fruits via cereals (e.g. muesli with raisins), bakery products (raisin bread, fruitcakes), and trail mixes. There is also a trend of adding dried fruits to salads, yogurts, and savory dishes for flavor and nutrition. This broadens usage beyond direct snacking.

Premium and Organic Products: Particularly in high-income markets, demand is rising for organic dried fruits and exotic varieties (e.g. dried mango, blueberries). This caters to health-conscious and gourmet consumers, though volumes are smaller compared to staples like raisinsgrandviewresearch.com.

Key Consumer Countries: In absolute terms, India and the United States stand out as large single-country consumers – India for volume (owing to its 1.4+ billion population and affinity for dried fruit in cuisine) and the US for value (due to higher retail prices and variety of products). Germany, the U.K., France, and China are other top consumer countries by market sizegrandviewresearch.com, each with significant import volumes. It’s worth noting that some top producers (e.g. Turkey, Iran, Egypt) also have high domestic consumption of their signature fruits, though a large share of their output is destined for export. Overall, consumption is growing fastest in Asia (India, China, Southeast Asia) and in health-conscious segments of Western markets, while remaining robust in the Middle East and Europestatista.commarketdataforecast.com.

Major Producing Countries and Regions

The production of dried fruits is geographically concentrated, reflecting where suitable fruit crops are grown and dried (either naturally or by processing). Total world dried fruit output was about 3.36 million MT in 2023/24 and has been relatively flat to modestly growing in recent yearsapi.iib.org.tr. Production is dominated by a handful of countries across the Middle East, Central Asia, and the Mediterranean, along with the United States.

Top Producing Countries (2023/24): The United States is the single largest producer, accounting for about 12% of global dried fruit outputapi.iib.org.tr. US production (~0.40 million MT) comes mostly from California’s raisin and prune industry, as well as cranberries (Wisconsin/Massachusetts)api.iib.org.tr. Close behind is Türkiye (Turkey), which contributes roughly 11% of global outputapi.iib.org.tr. Turkey is a leading grower of dried grapes, apricots, and figs, with its Aegean and Anatolian regions specializing in these fruits.

Several countries each provide on the order of 8–10% of world production. Saudi Arabia and Iran each represent about 10% of global dried fruit productionapi.iib.org.tr. Saudi Arabia’s share comes almost entirely from its date industry (the country is one of the world’s largest date producers). Iran is a major producer of both dates and raisins, with large vineyards and date groves; its climate in regions like Fars and Kerman yields substantial exportable surpluses of raisins and dates. Following these, India produces around 8% of the world’s dried fruits (estimated ~270,000 MT in 2023/24), largely from its raisin production in Maharashtra/Karnataka and some domestic datesapi.iib.org.tr. China is also notable, with Xinjiang province making China a significant raisin producer (China produces ~4–5% of global dried fruit, ~150,000 MT).

In the Middle East & North Africa (MENA), several countries are major sources due to massive date cultivation: Egypt, Iran, Saudi Arabia, Iraq, Algeria, and Tunisia all rank among top producers, thanks primarily to dates. For example, Egypt is the world’s largest date grower (over 1 million MT of dates annually), though much of this is consumed fresh/domestically. Iraq and Iran each harvest hundreds of thousands of tons of dates and raisins. Tunisia (with ~135,000 MT of dates in 2023/24) and Algeria (~160,000 MT) are leading date producers as wellinc.nutfruit.org. Many of these MENA countries consume a large part of their output but also contribute strongly to exports (see trade section).

Outside of MENA and the US, Turkey and the USA together account for roughly one-quarter of world dried fruit productionapi.iib.org.tr (reflecting dominance in raisins, apricots, figs, prunes, cranberries). Other notable producing countries include South Africa (around 90,000 MT, mainly raisins from the Orange River region), Chile (~130,000 MT, mostly prunes and some raisins), Uzbekistan (large raisin and dried apricot production, though statistics are less reported, it is among top raisin producers), and Afghanistan (traditional producer of raisins and apricots, albeit volumes are smaller). Production can fluctuate year to year based on crop yields – for instance, weather hazards like spring frosts in Turkey can dramatically affect dried apricot output (and prices), as seen in 2021 when Turkey’s apricot crop failure led to record high pricescommodity-board.com. Overall, production is broadly split between the Americas (North and South) and the Eurasia/Middle East belt, with smaller contributions from Africa and Oceania.

Regional Leaders: By region, the Middle East & North Africa (especially the Fertile Crescent and North African oases) is the largest source of dried fruit by volume due to date production. South and Central Asia (India, Iran, Uzbekistan) and Mediterranean Europe (Turkey) are critical for raisins and tree fruit drying. North America (USA) is dominant in certain categories (raisins, prunes, cranberries), while South America (Chile, Argentina) is prominent in prunes. Australia also produces dried grapes and tree fruits, though for a niche export market. This geographic distribution means the supply side of the dried fruit market is somewhat weather-dependent and subject to regional risks, but global diversification helps balance overall output.

Leading Exporters and Importers (Trade Flows)

Global trade of dried fruits is highly developed, connecting producing regions with consuming markets. In 2022, about 2.7 million MT of dried fruits were shipped internationallyinc.nutfruit.org – indicating that a large share of production enters global commerce (some production is consumed domestically at the source, especially dates). Both bulk B2B trade (for food processing) and retail-oriented trade (finished consumer products) are important, often overlapping in distribution channels.

Export Hubs: The Middle East is the world’s primary dried fruit exporting region by volumeinc.nutfruit.org. Within this region, Türkiye (Turkey) is the single largest exporter globally – in 2022 Turkey exported about 500,500 MT of dried fruitsinc.nutfruit.org, including its signature raisins (sultanas), dried apricots, and figs. Turkey’s strategic location and high-quality production make it a top supplier to Europe and beyond. Iran is another heavyweight exporter (supplying large volumes of raisins and dates), closely followed by Iraq and the UAE as major date exporters/re-exporters. For example, Iraq exported ~220,100 MT and the United Arab Emirates ~202,000 MT of dried fruits (mostly dates) in 2022inc.nutfruit.org. The Middle East (including countries like Iran, Iraq, UAE, Saudi, and Turkey) collectively accounts for a substantial portion of world dried fruit exports, thanks largely to dates and raisins flowing out of the region.

Outside the Middle East, other key export origins include:

North Africa: about 312,000 MT exported in 2022inc.nutfruit.org, mainly dates from Tunisia, Algeria, and Egypt. Tunisia in particular is known for exporting high-quality Deglet Noor dates.

North America: around 251,200 MT exported in 2022inc.nutfruit.org, virtually all from the United States (California). The U.S. is a top exporter of raisins (notably to Europe and Asia), prunes (dominates global prune trade via Sunsweet growers), and sweetened dried cranberries (Ocean Spray’s “Craisins” have created a global market).

South America: about 198,500 MT in 2022inc.nutfruit.org, largely from Chile and Argentina. Chile is the world’s leading exporter of prunes and also ships raisins; its ~100,000+ MT of prune exports make up a big share of this volume. Argentina exports peanuts and some dried fruits like prunes/raisins as well.

Central Asia: Though not explicitly broken out in the 2022 trade figures, countries like Uzbekistan and Afghanistan export significant quantities of raisins and dried apricots (often into South Asia and Europe).

Europe: Some intra-European trade exists (the Netherlands, Germany, France re-export dried fruits within Europeinc.nutfruit.org), but Europe as a whole is a net importer (discussed below).

In value terms, the leading exporters mirror the volume leaders but also include those who export higher-value dried fruits. Turkey by value is the top exporter (approx $499 million in 2023 for HS 0813 category alone)oec.world. Other top exporters by value include Chile ($324M, due to high-value prunes) and China ($259M, including its raisin exports)oec.world. The United States, Iran, South Africa, and Uzbekistan also rank high in export earnings from dried fruits (raisins and others). The competitive advantage in exports often comes from specialization: e.g., Turkey and Iran for raisins, Turkey for apricots/figs, the U.S. for prunes/cranberries, Chile for prunes, South Africa and Uzbekistan for raisins, and Tunisia/UAE for dates.

Import Markets: The flip side of these flows is that Europe is the world’s largest importing region for dried fruits. In 2022, Europe (EU + UK) imported about 1.0 million MT of dried fruitsinc.nutfruit.org – roughly one-third of global consumption – making it the top destination. European countries lack domestic production of many dried fruits (apart from some in Southern Europe), so they rely on imports from the Middle East, US, Turkey, etc. Within Europe, Germany, the UK, the Netherlands, France, and Italy are among the largest importers (Germany and the UK consistently lead due to their population size and food industries).

Asia is another major importing region, especially for dates and certain dried fruits: India is now one of the world’s largest single-country importers by volume, importing about 491,100 MT in 2022inc.nutfruit.org. These imports (mostly dates from the Gulf/Iran and raisins from Afghanistan/Central Asia) serve India’s vast consumer market. China imported around 111,000 MT in 2022inc.nutfruit.org, including prunes (from the US/Chile) and raisins (from US/Central Asia). Other significant Asian importers are Japan (raisins and prunes for its confectionery sector), Vietnam (some as a processing/transit point for cashew-related dried fruit mixes), and Pakistan (dates and raisins, though Pakistan also produces dates).

North America also imports dried fruit despite being a producer. The United States is the largest importer by value – in 2023 the US imported nearly $360 million worth of dried fruits, making it the top importer in value terms globallystatista.com. U.S. imports include specialty fruits not grown domestically (e.g. figs from Turkey, dates from MENA, some tropical dried fruits) as well as additional raisins to supplement domestic output in bad crop years. Canada is a smaller but steady importer, sourcing raisins, dates, and tropical dried fruits for its market.

Other notable import markets include the Middle East (some Gulf countries import raisins, prunes, and exotic dried fruits not grown locally), and Latin America (e.g., Brazil imports dried fruits for its food industry, though volumes are modest compared to Europe/Asia). Overall, global trade routes see dried fruits flowing from producing belts (California, Mediterranean, Middle East) to consumer markets in Europe, North America, and increasingly Asiainc.nutfruit.org. The trade is facilitated by large distributors and trading companies, and some countries (like the Netherlands, UAE, Turkey) act as re-export hubs – importing in bulk, then processing or repackaging and exporting to other marketsinc.nutfruit.org.

To summarize: Turkey remains the pivotal exporter of dried grapes, apricots, and figs, the U.S. leads in prunes and cranberries, and Middle East/N. Africa supply the world’s datesinc.nutfruit.org. Europe is the top import market by volume, while the U.S. and Germany are top importers by valuestatista.com. Trade volumes are expected to grow moderately through 2030 in line with consumption, with potentially higher growth in Asia’s imports as diets westernize and populations grow.

B2B Trade vs. Retail Consumption Trends

The dried fruit market serves two broad segments of demand: B2B (business-to-business) demand, where dried fruits are used as ingredients or inputs in manufactured foods and foodservice, and retail consumer demand, where dried fruits are sold directly to consumers as snacks or cooking ingredients. Both segments are evolving with distinct trends:

B2B (Industrial) Demand Trends

In the B2B channel, dried fruits are valued for their flavor, nutritional content, and functional properties in recipes. Food manufacturers and foodservice providers are major buyers of bulk dried fruits. Key uses include:

Bakery and Confectionery: Raisins, dried cranberries, and chopped dates/apricots are commonly used in baked goods (breads, cookies, fruit cakes) and chocolates or energy bars. The natural sweetness and texture of dried fruits make them ideal sugar substitutes or inclusions. For example, the chocolate and pastry industries have increased their use of raisins and dried fruits to add natural sweetness and fiber to productsfactmr.com.

Breakfast Cereals and Snacks: Many breakfast cereals (mueslis, granolas) and health snack bars include dried fruit pieces for flavor and nutrient appeal. The cereal industry in North America and Europe relies heavily on raisins, dates, and dried berries as mix-insmarketdataforecast.com. Trail mix producers buy bulk raisins, peanuts, dried banana chips, etc., to create packaged mixes.

Dairy and Yogurt: Dried fruits are used in some dairy products (like flavored yogurts or ice creams) to add fruit content without the perishability of fresh fruit.

Foodservice and Brewing: The hospitality sector uses dried fruits in making sauces, compotes for desserts, or even brewing (certain traditional beers or liqueurs use raisins/dates).

Trend: B2B demand is growing steadily as consumers push food companies to incorporate healthier ingredients. The “clean label” movement has encouraged manufacturers to replace refined sugars and artificial additives with natural ingredients like dried fruit pieces or pastesmarketdataforecast.com. As a result, the application of dried fruits in packaged foods is risingfactmr.com. Manufacturers are touting the inclusion of “real fruit” in snacks and cereals, which often means dried fruit content. Moreover, R&D findings that highlight health benefits of dried fruits (e.g. high antioxidant content aiding in disease prevention) have increased industry confidence in marketing such ingredientsfactmr.com. The growth of plant-based and vegan food products also benefits dried fruit usage, as they can act as sweeteners or binders in recipes where honey or eggs might have been used (e.g. date paste as a binder in vegan protein bars).

Another trend is product innovation by suppliers to better serve B2B needs. For instance, dried fruit processors now offer custom moisture levels, pre-chopped or powder forms, and infused dried fruits (e.g. cranberry infused raisins) to suit specific manufacturing requirementsfactmr.com. According to a recent outlook, demand for powdered dried fruits is rising (~5.4% CAGR expected) as these powders are used for flavoring and natural coloring in beverages and foodsfactmr.com. B2B trade often involves large contracts and steady year-round shipments. Price and quality consistency are key, leading to close relationships between producing-country exporters and food companies or importers. Through 2030, B2B demand is expected to remain robust, especially as breakfast and snack manufacturers worldwide incorporate more dried fruits for nutrition and clean-label appeal .

Retail (Consumer) Consumption Trends

On the retail side, dried fruits are sold directly to consumers in various formats – loose bulk, packaged bags, snack packs, or as part of mixed products (like nut/dried fruit mixes). Consumer preferences have been shifting in ways that generally favor increased dried fruit consumption:

Healthy Snacking: There is a clear trend toward snacking on nutritious, natural foods, and dried fruits fit this niche. Consumers view raisins, dates, figs, etc., as healthy alternatives to candy since they offer sweetness along with fiber and micronutrients. Surveys show health-conscious shoppers intentionally adding dried fruits to their diet as a daily snackfactmr.commarketdataforecast.com. The portability and long shelf life of dried fruit make it convenient for on-the-go snacking, which is increasingly important in modern lifestylesfactmr.com. We see dried fruit snack packs (single-serving boxes of raisins, mixed dried fruit medleys, etc.) becoming more common in supermarkets and vending machines. On-the-go consumption is a notable driver – e.g., hikers, students, and office workers opting for trail mix or dried fruit snacks for quick energyfactmr.com.

Culinary and At-Home Use: In many cultures, home cooking uses dried fruits for desserts or savory dishes (for example, raisins in Middle Eastern pilafs or in Indian biryani, prunes in European stews). As global cuisine becomes popular, consumers are buying specific dried fruits for recipes. Additionally, home baking saw a resurgence during the pandemic, lifting demand for raisins, dates, and dried berries as pantry staples.

Premiumization & Gifting: In markets like South Asia and the Middle East, gift packs of dried fruits and nuts are popular during festivals. There’s a premium segment of beautifully packaged dry fruit assortments. Similarly, Western markets have seen a rise in gourmet dried fruit – e.g., organic mango slices, chocolate-covered dried fruits, etc., catering to indulgence and gifting.

Organic and Clean-Label: Retail consumers are increasingly looking for organic certified dried fruits (no pesticides) and products with no added sugar or preservatives. Manufacturers have responded by expanding organic product lines and clearly labeling products as non-GMO, no sulfur dioxide (for apricots), etc.grandviewresearch.com. This has slightly increased prices but also drawn health-focused buyers.

Regional Retail Patterns: In the Middle East and South Asia, much of the retail consumption is still in more traditional forms (bulk purchases from markets, especially for dates and raisins). However, even there, supermarket sales of branded dried fruit packs are growing. In Western countries, almost all dried fruit is sold branded or private label in stores, with strong competition on quality and price. Retail sales in North America and Europe have been buoyed by product innovation – for instance, new flavors (like spiced or yogurt-coated dried fruits) and convenient resealable packaging to preserve freshness.

Retail demand also sees seasonal spikes: for example, dried fruit sales jump around year-end holidays in the West (for fruitcakes, plum puddings, etc.) and during Ramadan/Diwali in Muslim and Indian communities (when dates, raisins, figs are in high demand). Nonetheless, the overarching trend is towards making dried fruits an everyday snack rather than just a seasonal item, which boosts year-round consumption.

B2B vs Retail Balance: It’s estimated that a significant portion of dried fruit imports by volume go into further processing (B2B), but the retail (direct consumer) segment is expanding faster in many markets due to the snacking trend. Both segments are intertwined; for instance, a consumer’s preference for a cereal with raisins is indirectly driving B2B demand for raisins. Through 2030, expect retail consumption growth (especially of packaged snacks) to slightly outpace industrial use growth, as emerging market consumers pick up dried fruit snacking. Yet, B2B will remain the backbone of the market in terms of bulk volume (particularly for raisins, which are heavily used by industry). In summary, dried fruits are strengthening their position in both the ingredient supply chain and on retail shelves, driven by the convergence of health, convenience, and taste trends.

Historical and Projected Price Trends

Historical Price Movements: The dried fruit market has experienced price fluctuations influenced by agricultural supply cycles, crop events, and global demand shifts. Overall, prices for major dried fruits have trended upward modestly over the past decade, but with notable volatility in certain years for specific fruits:

Raisins (Dried Grapes): Raisin prices tend to swing with grape harvest yields in California, Turkey, and Iran. After a period of stability in the late 2010s, raisin export prices spiked in 2021 due to a smaller crop and global logistics issues, then eased in 2022 as supply recovered. For example, the average export price for dried grapes fell by about 6.9% in 2022 compared to 2021indexbox.io, reflecting improved supply (and possibly a stronger US dollar making exports cheaper). This followed a surge in 2021 when inventory was tight. As of 2023, raisin prices remain somewhat below their peak a few years priorindexbox.io, illustrating how quickly additional supply (from a good harvest) can temper prices.

Dried Apricots: This is one of the most price-volatile segments due to concentrated supply (Turkey is dominant) and susceptibility to weather. In 2021–2022, dried apricot prices hit historic highs. A severe frost in Turkey’s Malatya region (the primary apricot growing area) drastically reduced the crop in 2021, causing export prices to soar to record levels around $6,000+ per metric ton for top gradescommodity-board.com. Export prices for Turkish apricots roughly doubled from their long-term average, as reflected in quotes of $5,800–$6,300/MT FOB for various grades in late 2021commodity-board.com. These high prices persisted into early 2022. However, with a better crop in 2022/23 and some demand rationing, apricot prices began to decline; by 2023 the average import price for dried apricots had dropped to around $3,818/MT, down ~16.5% from the previous yearindexbox.io. This boom-bust pattern underscores how quickly dried fruit prices can adjust when a supply shock is resolved.

Dates: Date prices have generally trended upward gently, reflecting steady growth in demand and incremental supply increases. The market for dates is somewhat insulated from extreme volatility because many producing countries (e.g. in MENA) smooth domestic supply/use, and dates have cultural demand that keeps prices firm. Nonetheless, premium varieties like Medjool have fetched higher prices in recent years as global popularity rises. There have been some price effects from currency fluctuations (e.g., a weaker Tunisian dinar making Tunisian date exports cheaper in dollar terms in late 2010s), but no dramatic spikes akin to apricots.

Prunes and Figs: These markets are fairly stable. Prune prices saw a moderate rise in the late 2010s due to growing health demand, then stabilized. Figs, largely from Turkey, had a good supply in recent years keeping prices in check. No major disruptions have occurred recently; prices move mostly with general inflation and crop sizes.

External Factors: Broad factors like global supply chain costs and economic conditions also influence dried fruit prices. In 2021–2022, the COVID-19 pandemic recovery and the Russia-Ukraine war led to increased shipping costs and higher input prices (fertilizer, energy), contributing to higher dried fruit prices worldwideglobenewswire.com. Many suppliers raised prices in late 2021 to cover soaring freight rates. By 2023, as logistics normalized and inflation rates began to ease, some of those cost pressures abated, helping stabilize or slightly reduce prices for commodities like raisinsindexbox.io.

Price Outlook to 2030: Looking ahead, dried fruit prices are expected to remain on a moderate upward trend in the medium term, though large spikes cannot be ruled out if there are poor harvests. The baseline expectation is that growing demand will put gentle upward pressure on prices, but this will be partly offset by production growth and efficiency gains. Industry forecasts suggest prices will likely rise at or slightly above general food inflation rates through 2030 – perhaps on the order of a few percent per year. For example, if the market value CAGR is ~5.5% vs volume ~2–3%, that implies a ~2% annual increase in average unit prices in the long run.

However, volatility around the trend will persist. Key risks to watch:

Climate and Crop Yields: An unexpected drought, flood, or frost in any major producing region (California for raisins, Turkey for apricots/figs, etc.) could cause short-term shortages and price spikes. The apricot scenario in 2021 showed a sudden tripling of price due to weather. Similarly, a bad raisin grape harvest in Turkey or California in a given year could spike raisin prices globally until the next harvest. As climate change progresses, the frequency of such events could impact year-to-year price stability.

Exchange Rates and Trade Policies: Since dried fruits are traded globally, a strong USD can suppress dollar-denominated prices (benefiting US importers, hurting exporters), whereas a weak USD does the opposite. Trade tariffs or export restrictions (though rare in dried fruits) could also alter price dynamics.

Energy and Processing Costs: Drying and processing fruit is energy-intensive (for mechanical drying, cold storage, etc.). If fuel or electricity costs rise significantly, that can feed into higher prices for dried products. Conversely, improvements in drying technology or supply chain efficiency might contain costs.

In summary, historical prices have shown a mix of stability and sharp spikes for certain fruits. Going forward, prices are projected to gradually increase in line with demand, but the market will likely see intermittent volatility. Consumers and businesses should be prepared for occasional price surges in specific categories, although overall the sector is not expected to witness extreme sustained price inflation beyond normal food price trendsindexbox.ioindexbox.io. Many buyers (especially large food companies) manage this risk by forward contracts and diversifying sourcing regions.

Competitive Landscape and Major Companies

The global dried fruit sector is characterized by a mix of large growers’ cooperatives, specialized processing companies, and exporters/importers. Unlike some commodity markets dominated by a few giant corporations, the dried fruit industry has numerous significant players often focused on particular fruit types or regions. Below is an overview of the competitive landscape and key companies:

Cooperatives and Grower Associations: In several segments, grower-owned cooperatives play a leading role. For example, Sun-Maid Growers of California is one of the world’s most recognized dried fruit cooperatives, marketing raisins for over 800 California grape growers. Sun-Maid is effectively synonymous with raisins globally. Likewise, Sunsweet Growers (California) is the world’s largest handler of prunes, representing hundreds of plum growers and driving prune innovation. These cooperatives not only export but also have strong brand recognition in retail markets. They compete on quality and have marketing clout (e.g., Sun-Maid’s branded retail products).

Specialized Processors & Exporters: Many companies specialize in particular fruits or geographies. In the Middle East, Al Foah (UAE) is a major player – it processes and exports UAE’s dates and manages one of the largest date packaging facilities globallygrandviewresearch.com. Iran’s dried fruit sector includes companies like Sunexport and Sana Trading (focused on raisins and dates for export), though these are less internationally branded. In Turkey, numerous exporters handle specific products: e.g., TARİŞ (a cooperative in Turkey) is a big name in dried figs and sultanas; private firms like Kral Incir and Osman Akça are notable in figs and apricots. These companies compete by ensuring consistent supply and meeting EU quality standards (especially regarding food safety like aflatoxin control in figs and raisins).

Diversified Nut & Fruit Companies: Some companies straddle both nuts and dried fruits. Bergin Fruit and Nut Company (USA) and Red River Foods (USA) are examples of importers/distributors that handle a wide range of tree nuts and dried fruits, supplying wholesalers and food manufacturersgrandviewresearch.com. They might not be consumer-facing brands, but they have significant market share in B2B distribution by offering a one-stop solution for snack ingredients. Olam International, a global agri-commodity giant, also deals in dried nuts and might handle some dried fruit trading (though it’s better known for nuts and spices).

Regional Brands: In Australia, which has a long tradition of dried fruit (particularly sultanas and apricots), companies like Sunbeam Foods and Angas Park (brands under which Australian dried fruits are sold) have been prominentgrandviewresearch.com. Murray River Organics Group in Australia is another integrated producer-exporter focusing on organic dried vine fruitsgrandviewresearch.com. These compete both in export markets in Asia and domestically, often emphasizing organic or premium quality to differentiate from lower-cost imports.

Emerging Market Companies: With rising demand, new players are entering the market. For instance, Tulsi Nuts and Dryfruits (India) and Royal Nut Company (which operates in Australia) are examples of companies capitalizing on local demand by offering a wide variety of dried fruits and nutsglobenewswire.com. While not all are global exporters, they contribute to competitive dynamics in their home markets (often competing with imported products).

Value-Added and Niche Producers: Some firms focus on innovative dried fruit products. Paradise Fruits (Germany) specializes in freeze-dried fruit and infused dried fruit ingredients. Kiantama Oy (Finland) concentrates on wild Nordic berries dried/powdered for the food and nutraceutical industrygrandviewresearch.com. These niche companies compete on innovation, targeting the growing segment for functional foods and superfoods.

The competitive landscape is quite fragmented globally, but a few names stand out in each segment:

Sun-Maid and Lion Raisins (US) in raisins; Sunsweet (US) in prunes; Al Foah (UAE) in dates; major Turkish exporters (e.g., Turkish Exporters Union members) in sultanas, apricots, figs; Chilean processors like Prunesco in prunes; South African Dried Fruit Co. in raisins; etc. Consolidation has not been extreme – many of these are cooperative or family-owned businesses with deep expertise. That said, some global convergence is happening on the marketing side. For example, the largest companies often attend international trade fairs (like ANUGA, Gulfood) and compete to secure contracts in emerging markets. Brand-building is also evident: Sun-Maid’s red box or Sunsweet’s branding on prune snacks differentiate their product in retail, allowing some pricing power.

Competitive Strategies: Common strategies among major players include:

Product Line Expansion: Companies are launching new dried fruit products (e.g., mixed fruit snacks, chocolate-covered dried fruits, or diced fruit pieces for cereals). Innovation is a key strategy – as noted, many leading firms are introducing organic lines or new flavors to capture health-focused consumersgrandviewresearch.com. For instance, a company might launch a “no sugar added” dried berry mix to differentiate from standard offerings.

Quality and Food Safety: Given stringent import standards (especially in the EU for mycotoxins, sulfur levels, etc.), top exporters invest in quality control. Being known as a reliable, certified supplier is a competitive advantage. Some Turkish and Californian processors advertise their modern sorting and pasteurization equipment that ensures cleaner, safer products.

Vertical Integration: A number of players have integrated operations – from farming or grower networks to processing and packaging – to control costs and quality. This is seen in cooperatives (growers to market) and in companies like Al Foah which sources from farmers and packs under its brand. Vertical integration helps ensure supply stability and traceability, which are selling points.

Marketing and Origin Branding: Marketers promote origin and variety (e.g., “California raisins”, “Turkish apricots”, “Medjool dates from Israel/California”). Some companies leverage geographical indications or unique varietals to stand out. There are also generic promotion efforts by councils (like California Raisin Administrative Committee or the Turkish Fruit Exporters) that indirectly support companies by raising category awareness.

Major Companies (selection): According to industry reports, leading companies in the dry fruit sector include Sunbeam Foods, Sun-Maid Growers of California, AL FOAH, Bergin Fruit and Nut Company, Angas Park, Murray River Organics Group, Red River Foods, Geobres, Kiantama Oy, Traina Foods, and Sunsweet, among othersgrandviewresearch.com. Each of these has a strong position in one or more product categories or regions. For example, Sun-Maid and Lion Raisins handle large shares of the US raisin crop; Traina Foods (US) is known for sun-dried tomatoes and fruits; Geobres (likely a Mediterranean exporter) and Angas Park (AU) have specialty strengths. Additionally, National Raisin Company (US), Valley Harvest (US), Royal Nut Company (AU), and Tulsi Dryfruits (IN) are cited as notable players in various analysesglobenewswire.com. This diverse set of companies illustrates that the dried fruit industry has both century-old cooperatives and newer entrants vying for market share.

Competitive Outlook: As demand grows, competition may intensify, particularly in high-growth markets in Asia. Companies that can ensure consistent quality, comply with food safety regulations, and innovate with new products (like low-sugar or exotic fruit offerings) are likely to gain an edge. We may also see more strategic partnerships or mergers – for instance, ingredient suppliers partnering with growers in new regions to secure supply (some U.S. and European firms have invested in South African and Asian dried fruit projects). However, given the agricultural nature of the business, a level of fragmentation will remain, tied to the many different fruit types and growing locales. In essence, the competitive landscape will continue to feature a mix of global brands and specialized regional players, all contributing to a dynamic market that is expected to flourish over 2025–2030.

Sources: The data and insights above were compiled from industry statistics (FAO/INC), trade databases (ITC, UN Comtrade), and market research reportsapi.iib.org.trinc.nutfruit.orggrandviewresearch.comgrandviewresearch.com, including analyses by the International Nut & Dried Fruit Council and various national agricultural agencies. These credible sources underpin the forecast and trends presented, ensuring a well-founded outlook for the global dried fruit market through 2030.

- api.iib.org.tr

- https://api.iib.org.tr/files/anc_rapor1735025254995.pdf

- Dried Fruits Global Market Report 2023

- https://www.globenewswire.com/news-release/2023/03/15/2627522/0/en/Dried-Fruits-Global-Market-Report-2023.html

- Dried Fruit Market To Reach $16.55Bn By 2030 | CAGR 5.6%

- https://www.grandviewresearch.com/press-release/global-dried-fruit-market

- Dried Fruit Market Size, Competitors & Forecast to 2030

- https://www.researchandmarkets.com/report/dried-fruit?

- srsltid=AfmBOoqV3bzX6IAkCSs0QyXOCPk4Y9SQ7ulEvaAbKhdRgYlcsdjAq7bA

- Dried Fruits Market Size, Share, Trends & Analysis, 2033

- https://www.marketdataforecast.com/market-reports/dried-fruits-market

- Dried Fruits Market: Global analysis and forecast

- https://www.maximizemarketresearch.com/market-report/global-dried-fruits-market/118077/

- INC Publishes Trade Map Series - International Nut & Dried Fruit Council

- https://inc.nutfruit.org/inc-publishes-trade-maps-series/

- Dried Fruits Market Size & Share | Industry Growth By 2034

- https://www.factmr.com/report/dried-fruit-market

- Dried fruit market - statistics & facts - Statista

- https://www.statista.com/topics/6002/dried-fruit-market/

- Dried Apricots: Historical price increases

- https://commodity-board.com/dried-apricots-historical-price-increases/

- Dried Fruits (HS: 0813) Product Trade, Exporters and Importers

- https://oec.world/en/profile/hs/dried-fruits

- Dried fruits: leading importers worldwide 2023 - Statista

- https://www.statista.com/statistics/1025116/dried-fruits-leading-importers-worldwide/

- INC Statistical Yearbook Now Published – Key Insights Available to Members - International Nut &

- Dried Fruit Council

- https://inc.nutfruit.org/inc-statistical-yearbook-now-published-key-insights-available-to-members/

- Australia's Dried Grapes Market Report 2025 - Prices, Size, Forecast, and Companies

- https://www.indexbox.io/store/australia-dried-grapes-market-analysis-forecast-size-trends-and-insights/

- Dried Apricot Price in Turkey - 2025 - Charts and Tables - IndexBox.

- https://www.indexbox.io/search/dried-apricot-price-turkey/

Yorumlar - Yorum Yaz